Why I’m Sharing This 2-Month Review Now

Since November 2025,

I’ve been testing a new trading structure using

three separate $100 accounts.

Two months is not a long time.

But it is long enough to start seeing patterns

not just in results, but in how the system behaves under pressure.

This post isn’t about showing profits.

It’s about documenting what actually worked, what didn’t,

and how the structure itself is evolving.

The Structure I Tested: Rotation Trading

I call this approach Rotation Trading.

The rules are simple:

- Three separate accounts

- No adding to positions

- Every trade has a predefined stop-loss

- Once a stop-loss is hit, the next trade is taken on the next account

In practice:

- Stop-loss on Account 1 → next opportunity goes to Account 2

- Stop-loss on Account 2 → next opportunity goes to Account 3

- Stop-loss on Account 3 → rotation resets to Account 1

This cycle repeats continuously.

The main purpose of this structure is very clear:

To eliminate the risk of account-wide liquidation.

2-Month Summary (Nov–Dec 2025)

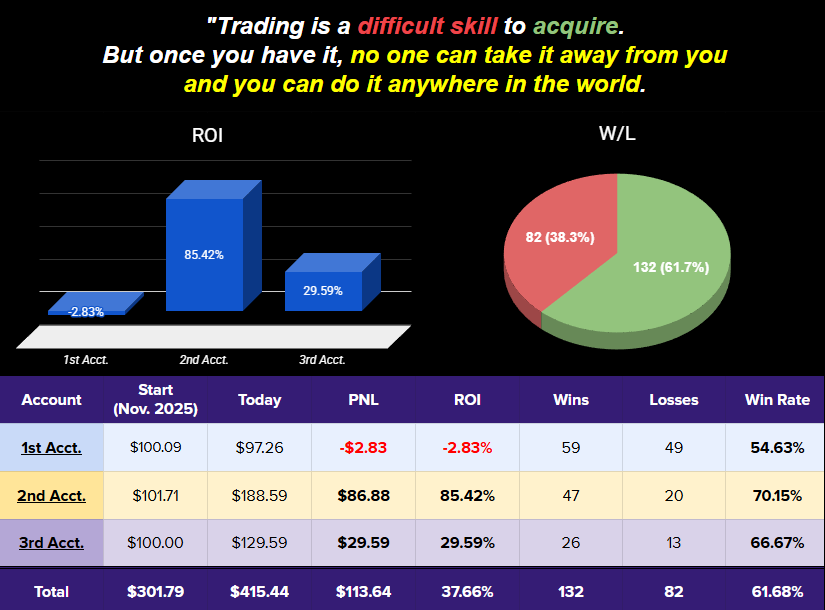

Here is the combined result after two months:

- Starting capital: $301.79

- Current balance: $415.44

- Net PnL: +$113.64

- Total ROI: +37.66%

- Overall win rate: 61.68%

However, the most important insight

comes from how each account performed differently.

What the Account-Level Results Revealed

▶ Account 1

- ROI: -2.83%

- Highest number of entries

- Most stop-losses

- High volatility

▶ Account 2

- ROI: +85.42%

- Win rate around 70%

- Most consistent equity growth

▶ Account 3

- ROI: +29.59%

- Win rate around 66%

- Fewer trades, but steady performance

At first glance,

Account 1 looked like a problem.

But after reviewing the data more carefully,

a different picture emerged.

Is Account 1 a Failed Account?

No.

What became clear over time

is that each account plays a different role within the system.

- Account 1: Market probe

(absorbs early risk, tests conditions) - Account 2: Execution account

(enters once conditions stabilize) - Account 3: Confirmation account

(participates only in the most favorable setups)

From this perspective,

the higher number of stop-losses in Account 1 is not a flaw,

it’s a form of risk containment.

Losses are absorbed early,

before larger exposure occurs.

The Conclusion So Far

The structure itself does not need to be abandoned.

But the risk distribution does need adjustment.

Starting January 2026,

I plan to make the following change:

- Rotation structure remains the same

- Entry logic remains unchanged

- Position size on Account 1 will be reduced by 50%

- Accounts 2 and 3 will continue as before

This adjustment is intended to:

- Reduce drawdown pressure from early entries

- Allow profitable accounts to compensate naturally

- Improve overall system stability

Why I Continue to Share These Records

This is not presented as a perfect system.

What matters more is that

decisions are being made based on records, not emotions,

and adjustments are driven by data, not hope.

I’ll continue documenting how this structure evolves

and whether these changes actually improve consistency.

What’s Next

In the next post,

I’ll take a closer look at date-level trade data,

including:

- periods with clustered stop-losses

- conditions where performance improved

Final Thought

Profit matters.

But sustainability matters more.

댓글